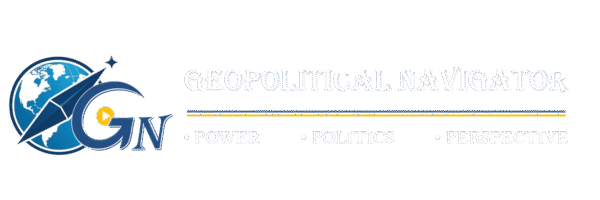

A Familiar Clash Between Budapest and Brussels

Hungary’s Prime Minister Viktor Orbán has never hidden his discomfort with the European Union’s hardening stance on Russia. Yet his latest intervention has raised eyebrows even by his own standards. As Brussels weighs whether to use more than €190 billion in frozen Russian state assets to support Ukraine, Orbán has issued a stark warning: such a move, he says, would amount to a “declaration of war.”

This is not just another episode of rhetorical sparring between Budapest and Brussels. It reflects a deeper unease within parts of Europe about how far the EU is willing—or able—to go in confronting Moscow, and at what cost to its own economic stability and legal foundations.

The Money at the Centre of the Storm

The assets in question are Russian central bank reserves that have been frozen in Europe since the invasion of Ukraine. Most of them sit within European financial institutions, particularly in Belgium. Initially, the decision to freeze these funds was seen as a powerful but measured response: Russia would be denied access to its reserves, without Europe crossing into legally murky territory.

That calculation is now changing. With Ukraine facing enormous reconstruction costs and Western military aid under growing strain, EU policymakers are searching for new sources of funding. The idea of using the interest generated by frozen Russian assets—or even the assets themselves—has gained momentum. For some in Brussels, it seems both practical and morally justified.

For Orbán, it is a step too far.

From Pressure to Provocation

Orbán’s core argument is that there is a meaningful difference between freezing assets and repurposing them. Sanctions, he suggests, are a political tool; confiscation is something else entirely. By warning that such a move would amount to economic warfare, Orbán is arguing that Europe risks turning itself from a party applying pressure into a direct participant in the conflict.

Whether one agrees or not, this framing resonates with a broader concern: once sovereign assets can be seized for political reasons, the rules of the global financial system begin to look less stable. Orbán has repeatedly warned that today’s exceptional measures could become tomorrow’s dangerous precedent.

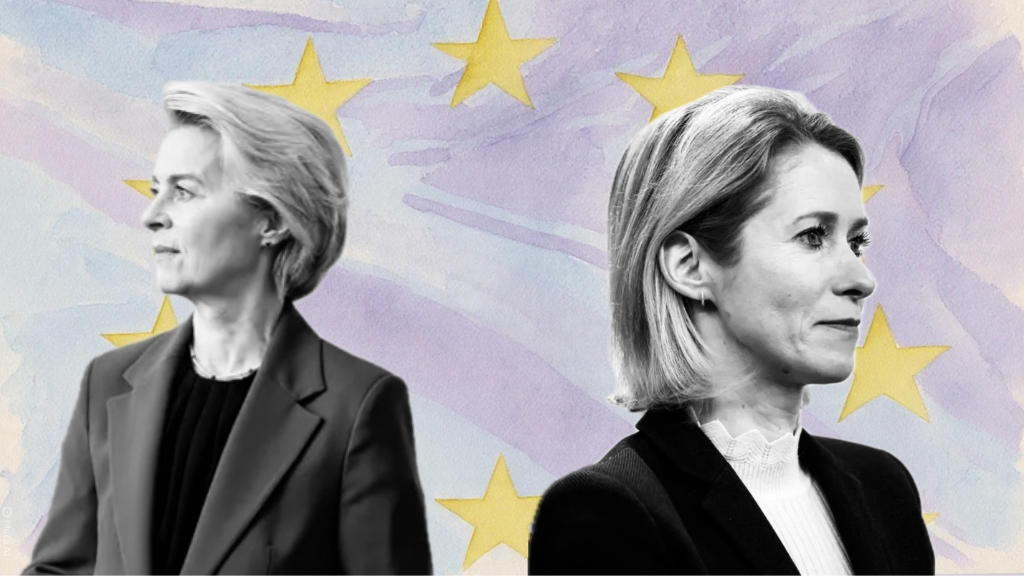

A Message Aimed Squarely at EU Leadership

Orbán’s remarks were also clearly aimed at Brussels’ political leadership. Without naming names, he took a swipe at European Commission President Ursula von der Leyen, accusing EU leaders of pushing Europe toward confrontation while presiding over what he described as “ruined economies.”

This line of attack is carefully chosen. Across Europe, voters are grappling with high energy costs, inflation, and sluggish growth. While support for Ukraine remains strong in many countries, there is also a growing sense of fatigue. Orbán’s message is that Europe’s economic pain is not incidental—it is the price of decisions taken by distant institutions that may underestimate their long-term consequences.

The Legal Grey Zone

Beyond politics, there is a genuine legal debate at play. International law has long treated sovereign assets as sacrosanct, even during wartime. Freezing assets is one thing; permanently seizing them is another. Legal experts have warned that moving from one to the other risks undermining confidence in European financial systems.

For a bloc that prides itself on the rule of law and predictability, this is no small issue. Orbán’s critics may question his motives, but his legal argument is not easily dismissed.

Why Many EU States Disagree

Still, Orbán’s stance has only sharpened divisions within the EU. For countries closer to Russia’s borders, the debate looks very different. From their perspective, Russia has already torn up the rulebook. The invasion of Ukraine, they argue, destroyed the post–Cold War security order, making exceptional responses unavoidable.

For these states, using frozen Russian assets is not reckless escalation but a form of accountability. In their eyes, Hungary’s objections weaken Europe’s collective response at a moment when unity matters most.

Europe’s Broader Dilemma

The dispute over frozen Russian assets exposes a deeper problem for the EU: it wants to act decisively on the world stage, but it struggles to agree on how far it should go. As the war drags on, the financial, political, and legal costs of supporting Ukraine are becoming harder to ignore.

Orbán’s warning forces Brussels to confront uncomfortable questions. How much risk is Europe willing to take? Can it bend long-standing norms without undermining its own credibility? And, perhaps most importantly, can the EU maintain unity when its members fundamentally disagree on what escalation looks like?

More Than a Fight Over Money

In the end, this is not just a dispute about €190 billion. It is about Europe’s identity and its limits. Orbán may be using dramatic language, but his intervention highlights a reality that EU leaders cannot wish away: Europe’s greatest challenge in confronting Russia may not come from Moscow alone, but from unresolved divisions within the Union itself.