You’ve probably heard that AI is the next big thing. ChatGPT, Gemini, and other chatbots have become part of daily life for millions. But behind the scenes, something stranger is happening: the biggest tech companies and richest countries are locked in a trillion-dollar game of musical chairs, and when the music stops, the losers could be entire nations.

The Money Loop That’s Worrying Experts

Here’s the unusual part: the same money keeps cycling between the same handful of companies. Nvidia, which makes the computer chips that power AI, has invested billions in OpenAI, the company behind ChatGPT. OpenAI then uses that money to buy more Nvidia chips. Meanwhile, tech giants like Microsoft, Google, and Meta are all buying Nvidia chips with their advertising profits, and Nvidia is investing some of that money back into the same companies.

It’s like a group of friends lending each other money to buy things from each other’s businesses. Everyone looks rich on paper, but if one person can’t pay, the whole system could collapse.

This circular flow has already reached staggering levels. In 2025, Big Tech companies are expected to spend over $400 billion just on AI infrastructure: data centers, chips, and cooling systems. That’s more money than the entire GDP of countries like Norway or Israel. AI-related stocks now account for 75% of returns in the S&P 500 stock market since ChatGPT launched.

Why Countries Are Suddenly in the Game

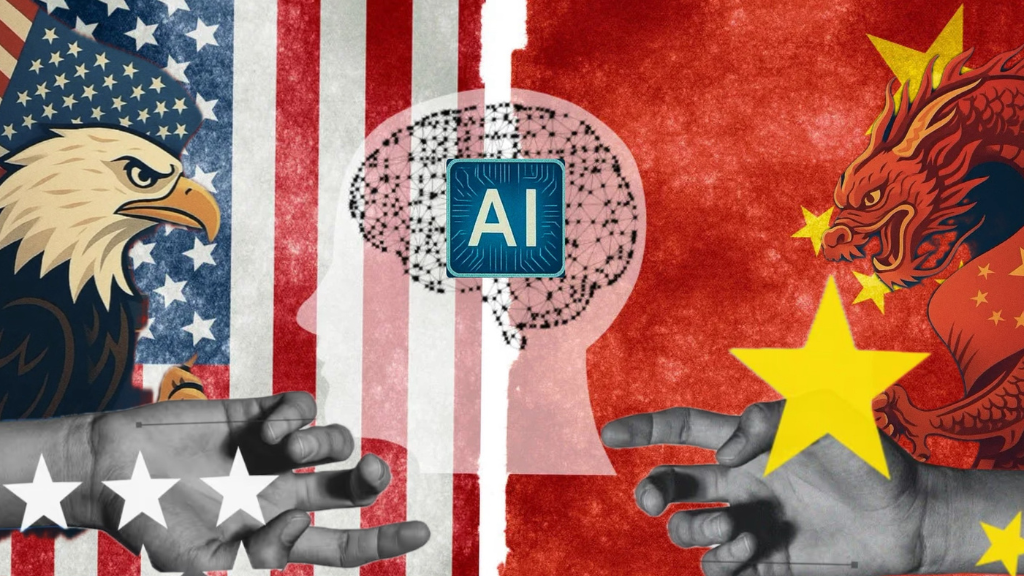

This isn’t just a tech story anymore. It’s become a power struggle between nations. The United States realized early that whoever controls AI chips and data centers essentially controls the future economy and military capability. So, Washington has systematically blocked China from buying advanced chips, even banning specially designed chips that initially met export rules.

China is now scrambling to build its own chip industry. By May 2025, Chinese company Huawei had produced competitive AI chips despite U.S. restrictions, and manufacturer SMIC is reportedly making cutting-edge 5-nanometer chips. The world is splitting into two separate technology universes, one led by America, another by China, and every country is being forced to pick a side.

Meanwhile, oil-rich Gulf states saw an opportunity. Saudi Arabia and the United Arab Emirates are pouring tens of billions into AI deals with OpenAI, Google, Microsoft, and others. Saudi Arabia’s sovereign wealth fund is discussing investing hundreds of millions in OpenAI’s latest $40 billion funding round, alongside India’s Reliance Industries and UAE’s MGX fund.

Why would oil kingdoms invest in AI? They’re treating it as “the new oil,” a way to stay relevant as the world moves away from fossil fuels. In return, tech companies get the capital and cheap energy they desperately need. Data centers consume enormous amounts of electricity, and Gulf states have both money and power to spare.

Google Cloud and Saudi Arabia announced a $10 billion partnership in May 2025 to build AI hubs. OpenAI is building massive data centers in Abu Dhabi with Emirati firm G42. Even Anthropic, a competitor to OpenAI, is now courting Gulf money after its CEO admitted in a leaked memo that staying at the cutting edge has become “substantially harder” without Middle Eastern capital.

The Hidden Risks

Here’s what worries analysts: because everything is so tightly connected, one shock could bring down the entire system. If there’s a political crisis with a Gulf state, suddenly billions in chip orders evaporate. If power grids can’t keep up with data center demand (already happening in parts of the U.S.), multi-billion dollar AI projects stall.

Data centers are also creating local crises. From Mexico to Ireland, communities are experiencing blackouts as these facilities drain power grids. Unlike factories that employ thousands of workers, data centers often employ just a few dozen people while consuming energy equivalent to entire cities.

And there’s a math problem: to justify the $400 billion spent on AI data centers in 2025 alone, the industry needs to generate $320 billion in revenue just to break even, and that’s assuming a generous 25% profit margin. The chips become outdated in 1 to 3 years, so companies are in a constant race to build more, spend more, and hope customers eventually pay for it all.

Some experts now compare this to the dot com bubble of the late 1990s, when internet companies burned through billions before most went bankrupt. By late 2025, AI companies were trading at valuations not seen since that bubble, with the five largest tech firms holding 30% of the entire U.S. stock market, the greatest concentration in half a century.

What This Means for Countries Like India

For countries outside the U.S. China rivalry, the stakes are enormous. India faces a tough choice: either plug into the American system (getting access to cutting edge AI but becoming dependent on U.S. chips and cloud services), or try to build its own AI infrastructure from scratch (maintaining independence but competing against a trillion-dollar ecosystem).

India is attempting a middle path, pushing for “AI sovereignty” through domestic chip manufacturing, secure data centers, and indigenous AI models. Reliance Industries is in talks to invest in OpenAI while simultaneously building Indian AI capabilities.

But the fundamental reality is brutal: whoever controls the compute infrastructure (the chips, data centers, and energy to power them) will control economic growth, military capability, and political autonomy in the 21st century. It’s the new version of controlling oil fields or shipping lanes.

The Bottom Line

What started as excitement about chatbots has morphed into a geopolitical scramble where tech companies have become as powerful as nations, and nations are treating data centers like military bases. Hundreds of billions are circulating in a closed loop between a handful of players, all betting that AI will justify the spending.

Maybe they’re right, and AI will transform everything as promised. Or maybe we’re watching the early stages of a spectacular bubble, one where the fallout won’t just hit stock portfolios, but will reshape which countries hold power in the coming decades.

Either way, the decisions being made right now in Silicon Valley, Washington, Beijing, and Gulf palaces will determine who wins and who loses in the AI age. And unlike previous tech revolutions, this time entire nations (not just companies) are at stake.